If you have FFEL loans, you NEED to know about this upcoming deadline!

Mar 27The IDR Account Adjustment

What is it?

This is a huge opportunity for borrowers to get credit toward PSLF and/or IDR forgiveness by getting credit for past payments that wouldn't ordinarily count. You may need to take action depending on the types of outstanding loans you have and what option you're pursuing (PSLF or IDR forgiveness). Keep reading for a tutorial on how to determine what, if anything, you may need to do before the April 30, 2024, deadline!

Step 1: Review Your Outstanding Loan Types

If you're unsure what type of outstanding loans you have, you'll need to log into studentaid.gov and look them up. I recorded a short YouTube tutorial on how to do this. If you have FFEL loans, this quick tutorial shows you how to determine whether they're commercially held or held by the Department of Education.

Step 2: Determine which forgiveness opportunity you're pursuing.

Once you know what type(s) of outstanding loans you have, your action steps depend on the kind of forgiveness you're pursuing (or would like to pursue). I have a quick synopsis of both options below.

Public Service Loan Forgiveness (PSLF)

The PSLF Program forgives the remaining balance on your Direct loans after you've made the equivalent of 120 qualifying monthly payments under an accepted payment plan and while working full-time for an eligible employer. The accepted payment plans are the four income-driven repayment (IDR) plans: SAVE, PAYE, IBR, and ICR. Loans forgiven through PSLF are federally tax-free.

Only Direct loans are eligible for PSLF. If you have federally-held or commercially-held FFEL/FFELP loans, you must consolidate by April 30, 2024! More on this below.

Income-Driven Repayment (IDR) Forgiveness

The remaining loan balance is forgiven after making payments for 20 or 25 years on an IDR plan. This is usually considered taxable income at the state and federal levels. However, it is currently paused from being federally-taxed through 2025. Most states have also paused it, but not all! If you're in Wisconsin (like me), unfortunately, they've continued to tax it at the state level.

Only Direct and federally-held FFEL/FFELP loans are eligible for IDR forgiveness. If you have commercially-held FFEL/FFELP loans, you must consolidate by April 30, 2024! More on this below.

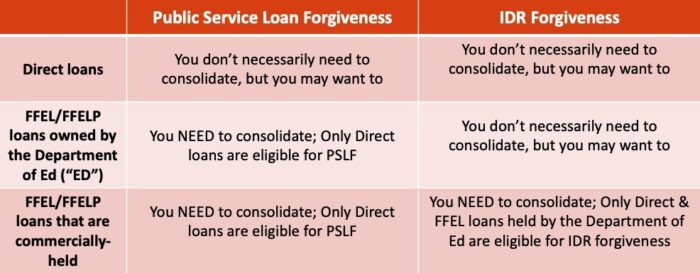

Step 3: Use the chart below to determine your action steps.

Once you've clarified what type(s) of outstanding loans you have and which forgiveness opportunity you're pursuing, use the chart below to determine your action steps. If the chart indicates that consolidation is necessary, you MUST submit a consolidation application on studentaid.gov by April 30, 2024, to avoid losing all progress.

By consolidating by April 30, 2024, you will get credit toward PSLF or IDR forgiveness for past payments that wouldn't ordinarily count. If you consolidate after the deadline, you will start all over again.

Let Emma do the hard work for you!

You've worked too hard for too long to let this opportunity slip by.

Comments

comments powered by Disqus