Biden Unveils New Student Loan Forgiveness Plans

Apr 09Biden Unveils New Student Loan Forgiveness Plans

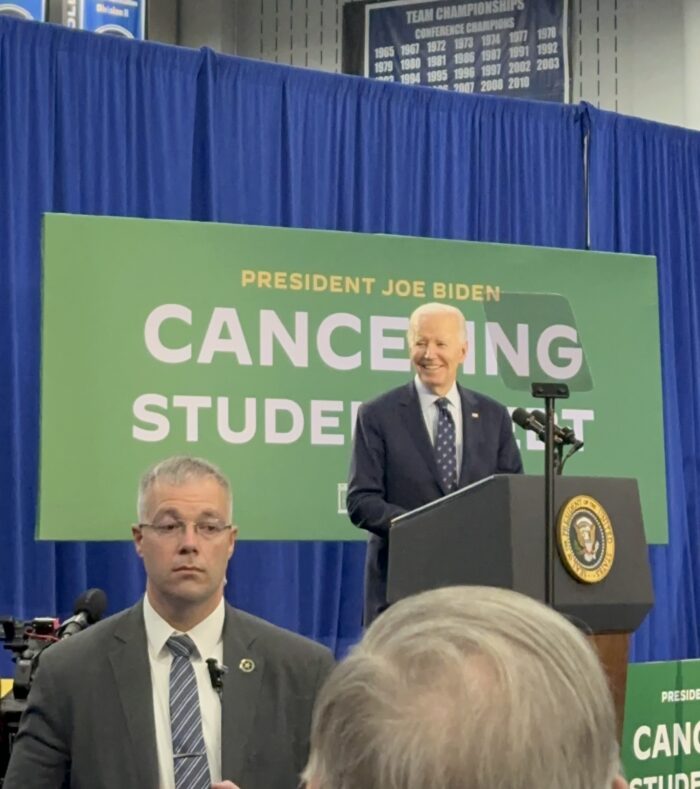

I was lucky enough to be a face in the crowd at Madison College on Monday, April 8th, where Biden unveiled his newest plans to extend student loan relief to millions of federal student loan borrowers. He detailed the five key features of his plan, which I've highlighted below. If these proposed solutions move forward as planned, he expects them to be implemented in fall 2024 at the earliest.

1. Cancel runaway interest

For those of us burdened with student loan debt, the interest often seems to run away, making it challenging to pay the loans off. However, under this plan, up to $20,000 of unpaid, accrued interest could be canceled for borrowers whose loan balances have grown since entering repayment. Notably, single borrowers earning $120,000 or less and married borrowers earning $240,000 or less are eligible, ensuring a wide range of borrowers can benefit without needing to apply.

2. Cancel debt for borrowers eligible for loan forgiveness under SAVE, PSLF, closed school discharge, or other forgiveness programs who are not currently enrolled

Tens of thousands of borrowers are eligible for forgiveness programs. Unfortunately, they may not 1) know that they're eligible or 2) be able to overcome the significant and burdensome hurdles of paperwork, horrible advice from their student loan servicer, or other obstacles. The Department of Education would identify borrowers who fall into these categories and cancel their debt without requiring an application.

3. Cancel debt for borrowers who entered repayment over 20 years ago

Due to the lack of systemic tracking of borrowers pursuing forgiveness under the 20- and 25-year income-driven repayment plans, many borrowers still face surmountable debt when it should have been forgiven years ago. Borrowers with undergraduate student loan debt would qualify for debt cancelation if they first entered repayment 20 years ago; borrowers with any graduate school debt would be eligible if they entered repayment 25 years ago. Direct loans and direct consolidation loans would be eligible. Borrowers do not need to be on an income-driven repayment plan to qualify.

4. Cancel debt for borrowers who enrolled in low-financial-value programs

This would cancel student loans taken out in programs that eventually lost their eligibility to participate in the Federal student aid program or were denied recertification due to shady business practices. It would also cancel student loans taken out during programs that eventually closed and failed.

5. Cancel student debt for borrowers experiencing hardship

Biden explained that borrowers currently in default (or at high risk of eventually being in default) would qualify for this. Additionally, borrowers experiencing other financial difficulties, such as medical debt and high childcare costs, could apply for this relief.

Stay tuned for more information!

I would be shocked if various lawsuits weren't already in the works to try to bring these plans to a halt. I'll be sure to blog as I learn more!

Comments

comments powered by Disqus